Peabody pondering life after its North Goonyella Mine October 16 2018

Having recently eyeballed his problem with spontaneous combustion at North Goonyella, the next date with destiny for Peabody Energy boss Glenn Kellow will be the coalminer’s third-quarter earnings call, which will close out what has been a messy October for man and company.

In just more than two weeks, the BHP-trained Kellow is certainly going to be pushed by US analysts and others to offer some sort of guidance on when or if they might expect productive digging to start again at the stalled mine.

The odds are that Kellow will not be able to oblige with anything like clarity or certainty.

We have argued that Peabody was a little slow in getting news of its gathering Queensland calamity to its investors. While the company does not accept our view, it is now moving subtly to get its public narrative ahead of the curve.

To refresh, it took Peabody nearly three weeks to tell its owners that digging at North Goonyella had been halted by gas issues and that the problem would extend the production halt caused by the scheduled move of longwall mining equipment from panel 9 to panel 10. That disclosure was make in the wake of inquiries by The Australian Financial Review.

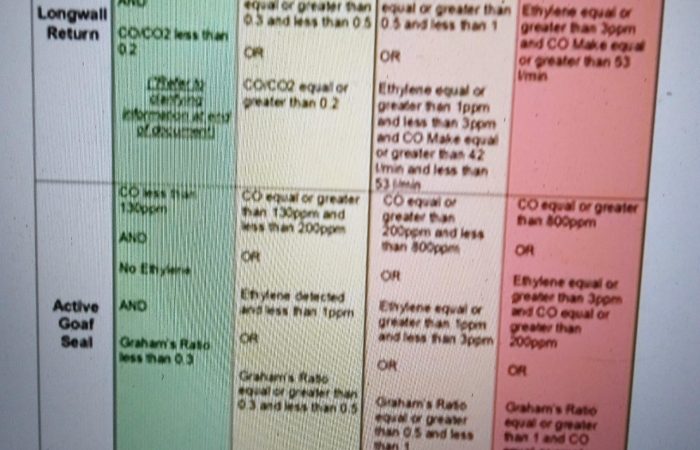

We reported on September 19 that company had confirmed the gas problem but rejected suggestions that the mine also ran the risk of spontaneous combustion. The company said that operational management had reported falls in both gas and temperature levels and while the movement of longwall mining kit had been delayed, mining life would return to normal through the December quarter.

Either that was wishful thinking or North Goonyella is a wildly unpredictable beast. Because by the final week of September, according to an internal union report, gas levels was running at extraordinary levels and the mine had fallen victim to spontaneous combustion.

The longwall panel that is identified as the most likely cause of the gas accumulation and subsequent fire is in the process of being permanently sealed as a means of snuffing out the fire and mitigating the gas problems. That task is absorbing an estimated 65 per cent of North Goonyella’s workforce, with the vast majority of the rest either being deployed at other nearby Peabody mines or taking leave.

But it looks increasingly likely that, once the containment process is completed, that is going to be that for North Goonyella.

Last week, after promising an update on its third-quarter call, Peabody flagged the need to absorb provisions on equipment that will be entombed in the mine and indicated that it now expected “financial impacts to future periods”.

So, while mine management and state regulators continue frantic work to recover order at the gas and fire-blighted former cash cow in central Queensland, it rather looks like investors and Peabody management are preparing for a financial life without North Goonyella.

Since we encouraged Peabody to public acknowledgement of the emerging problems at North Goonyella back on September 19, the US coal play has surrendered about $U1 billion in market capitalisation. The near $US8-a-share retreat effectively announces investor scepticism that Peabody will ever return to work at North Goonyella.

The quantum of that re-rating seems appropriate when you consider mine’s financial contribution to the mothership in St Louis.

Last year, Peabody made a profit of $US498 million. According to local ASIC filings by the Peabody entity that claims North Goonyella as its main business, the Australian mine generated about $US100 million of that.

There is plenty of coal left at North Goonyella. There is a southern extension to the mine plan that was due to host a new longwall from them mid-point of 2019 and be in full production by next year’s end. And there is a deeper coal seam under the existing northern panels.

But, as of today, Peabody management is unable to make call yet on whether the coal fire that started spontaneously some 380 metres below the surface in late September is out. And neither is management in a position to say that the carbon monoxide and methane gas levels that force the suspension of mining back on 1 September have been mitigated.

That, of course, means management has been wholly unable to assess the damage caused since the workers retreated from the mine over six weeks ago. And all of that makes an impossibility of the task of predicting where, when and how mining might restart at North Goonyella.

Meanwhile, it is nice to see that the Queensland leadership of the coal miner’s union has got its priorities right.

While North Goonyella smoulders and Glencore moves to carve 400 jobs from its recently acquired Hail Creek mine in central Queensland, the president of the Queensland branch of the CFMEU, Stephen Smyth, has trooped off to London spend an hour protesting outside of BHP’s annual general meeting.

Smyth and a VP from the union’s NSW branch, Jeff Drayton, have parachuted in to join unionists from Brazil, Canada and Colombia in shouting out BHP’s many and varied failings.

Meanwhile, back at the coal face …

https://www.afr.com/companies/peabody-pondering-life-after-its-north-goonyella-mine-20181016-h16pr8